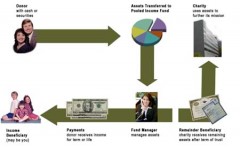

The pooled income fund (PIF) is often referred to as the “mutual fund of life income gifts.” A gift of cash or securities is transferred into a pooled income fund at Deseret Trust Company, which, as trustee, manages the assets and pays an income for life to you or the income beneficiaries you designate. At the death of the income beneficiary, the remaining assets left in the pooled income fund account are transferred to the Marriott School.

The typical donor:

- Needs variable income for life

- Seeks income that is market sensitive

- May participate in different pooled income accounts for varied needs

- Is between the ages of 55 and 80

Gifts features and benefits:

- Income for life, market sensitive

- Mutual fund approach to a charitable trust

- Reinvestment of assets transferred to the trust

- Deseret Trust Company manages the fund

How Do I Make a Gift of a Pooled Income Fund?

Deseret Trust Company has created and manages several pooled income funds. After cash or marketable securities are transferred to Deseret Trust Company, these assets are pooled, reinvested, and managed with other donors’ assets to leverage investment performance. A percentage share of the income earned in the fund is paid to you or the income beneficiaries you choose. When the income beneficiaries die, the remaining assets in your portion of that fund are transferred to the Marriott School.

Before you begin, you need to make sure your financial and legal advisors are part of your gift strategy team. A gift using one of Deseret Trust Company’s pooled income funds can have an impact on other parts of your financial and estate plan. The professional staff at LDS Foundation can assist you and your advisors in completing your gift.

Other Facts You Should Know about a Pooled Income Fund

The income tax deduction you receive when giving through a pooled income fund is based on an Internal Revenue Service formula that considers your age, the ages of other income beneficiaries, the projected assumed payout of the fund, and a federal index rate. The older you are at the time you make a pooled income fund gift, the larger your income tax deduction based on the amount of gift transferred.

The trust provisions you have control of when giving through a pooled income fund include:

- Naming the income beneficiaries

- Choosing the charitable remainder beneficiaries

- Selecting the frequency of income payments

BYU Marriott

BYU Marriott